Defensive Asia Credits Help Investors Navigate Market Volatility

2022Q4 Market Outlook - Asian Bonds

|

|

|

Tug-of-war between rate hike quelling inflation vs inducing recession; US Treasuries face upward pressure

Tug-of-war between rate hike quelling inflation vs inducing recession; US Treasuries face upward pressureThe Fed has been aggressively raising rates, but the impact on the economy has yet to emerge. Investors fear the central bank could overshoot and send the economy into recession. Market volatility increased as these two forces came into play. BEA Union Investment expected further rate hikes before the end of the year, while the US treasuries faced upward pressure. We also turned slightly cautious towards bonds with long duration. US nonfarm payrolls increased by 315,000 in August. Albeit the job market showed signs of easing, the country's services and labour market were still resilient. Together with surging gas prices in Europe, markets could see repricing of US treasuries on expectations of a potentially faster rate hike trajectory.

US inflation slowed as commodity prices retreated from their one-year high. Supply chain delivery time also showed improvements and global demand subsided on weaker economic growth, China in particular. But inflation trajectory uncertainty remains. August CPI rose 8.3% year on year, slightly down from July's 8.5% year-on-year increase. But on a monthly basis, there was an uptick. Excluding food and oil prices, August inflation rose 0.6% month on month, higher than market expectation's 0.3% increase. The Fed pledged to keep raising rates until inflation returns to 2%, even if it meant a sustained period of below-trend growth. Investors should keep a close eye on the upcoming trend.

Prefer defensive, high quality Asian credit

Economic health and challenges were mixed for Asia. China aside, most Asian countries, including Singapore, Japan and South Korea, have relaxed pandemic restrictions, supporting economic activities.

While Australia, Malaysia, Singapore and South Korea, among others, trailed the US to hike rates, inflationary pressures were relatively mild in Asia, and the region's economies more robust. South Korea has been one of the forerunner in normalising its interest rates, resulting in a more stable bond market when volatility gripped global markets. In early September, the country said it will shrink government spending to quash inflation.

Indonesia has expected 2022 inflation could reach 6.6-6.8%, higher than 4.69% in August. The government said rates will continue to climb, but extent will be less than that of the US. A more disciplined rate hike path, plus elevated coal and palm oil prices, have helped steadied the country’s bond market and benefit commodities firms.

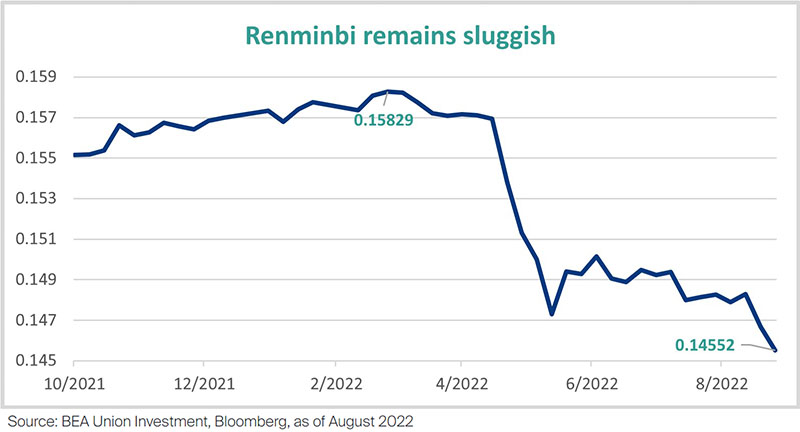

To ensure liquidity and support economic activities, the PBoC cut rates in mid-August, sending USD/CNY and onshore bond yields lower. Shortly after, the central bank lowered its FX reserve requirement ratio to limit Renminbi weakness. BEA Union Investment believed the Renminbi will remain weak against the USD as it would take time to resolve China’s mortgage boycott crisis, while the country’s pandemic policies continued to dampen the retail sector. The growing divergence between US and China's monetary policy is also another factor that keeps a lid on the Renminbi 's strength against the USD. At the same time, onshore bond yields will likely hover at low levels.

Our investment teams held a cautious stance towards Chinese bonds. But select sectors, such as technology, media and telecom (TMT), appeared attractive on valuations and improving market sentiment. Equally appealing are select non-Chinese high-yield Asian bonds which were offering juicy yields of about 7-15%.

Geographical analysis

See investment potential with South Korea newly-issued investment grade financial bonds due to attractive valuations, high quality

South Korea started shifting away from its pandemic-era stimulus last August, raising rates as early as August last year. Even though the rate cycle has not come to an end, the size is returning to more normal levels. The government has been supporting financial firms through liquidity in times of difficulty. This helped stabilise investors' confidence towards the country's bond market. BEA Union Investment remained constructive of Korean investment grade for its defensive nature and attractive yield carry, especially short-end of curve. Our investment teams particularly favour short-dated new issuances with good premium, attractive valuations with A-rating or above. New issuance was muted during summer, but we expect them to pick up shortly and continue to offer good premiums.

South Korea started shifting away from its pandemic-era stimulus last August, raising rates as early as August last year. Even though the rate cycle has not come to an end, the size is returning to more normal levels. The government has been supporting financial firms through liquidity in times of difficulty. This helped stabilise investors' confidence towards the country's bond market. BEA Union Investment remained constructive of Korean investment grade for its defensive nature and attractive yield carry, especially short-end of curve. Our investment teams particularly favour short-dated new issuances with good premium, attractive valuations with A-rating or above. New issuance was muted during summer, but we expect them to pick up shortly and continue to offer good premiums.

Positive on India’s high yield renewables, supported by robust fundamentals and improving policies

The Reserve Bank of India raised rates by 50 basis points in August. Inflationary pressure was ebbing while economic momentum held firm. The country’s renewable high yield papers were propped up by a plethora of favourable policies and rosy fundamentals. Long-term concession and fixed prices also contributed to the sector's positive outlook.

Recently, the country’s Prime Minister Narendra Modi urged state governments to gradually clear their US$13 billion worth of outstanding dues towards power generators. Also, the country has committed to produce half of its electricity requirements from clean energy by 2030, while in the same year, bolstering renewable energy capacity to 500GW by 2030 from 151GW in 2021. Our investment teams expected a spate of funding channels will remain accessible to renewable companies, and at reasonable borrowing costs, for refinancing and funding new projects.

Chinese developers in distress; stay cautious on property, banks bonds

China’s economic outlook will hinge on whether the country is prepared to shift its pandemic policies and how fast its easing measures could be put in place. Due to regulatory risk in select industries and lacklustre housing sentiment, BEA Union Investment remained cautious towards investment-grade and high-yield Chinese bonds in general. But opportunities began to emerge in select sectors, such as asset management as well as technology, media and telecom. These sectors could stage a technical rebound because valuations have substantially retreated, and supplies remain tight.

China’s economic outlook will hinge on whether the country is prepared to shift its pandemic policies and how fast its easing measures could be put in place. Due to regulatory risk in select industries and lacklustre housing sentiment, BEA Union Investment remained cautious towards investment-grade and high-yield Chinese bonds in general. But opportunities began to emerge in select sectors, such as asset management as well as technology, media and telecom. These sectors could stage a technical rebound because valuations have substantially retreated, and supplies remain tight.

Unfinished housing projects in China rose to more than 300 in late July from 200. As buyers stopped paying mortgages and contract sales remained sluggish, many developers were struggling with liquidity. Default rate is expected to tick up further.

As courts and the government leaned towards consumer protection, banks could take the hit and end up bearing most of the losses. BEA Union Investment believed the impact on four big national banks would be controllable but uncertainty looms with joint stock banks and rural banks. Contract sales in August from the top 100 developers fell 13% from July. Albeit there had been speculations of massive financial plans to rescue embattled developers, our investment teams remained cautious towards the outlook of Chinese property bonds. Lest the property crisis spread further into the financial sector, our teams remained highly selective in investment-grade financial and asset management company bonds.

Prefer Indonesian oil and gas investment-grade quasi bonds; Rosy fundamentals with high-yield property

Indonesia's fundamentals held steady. So does its currency. The country's PMI remained in expansion mode. Thanks to high palm oil and coal prices, account surplus hit new highs.

Even though the Indonesian government expressed intention to keep rates rising to quell rising inflation, but it made clear that the magnitude will not be comparable to that of the US. For that reason, together with still high commodities prices, Indonesia's bond market still has its allure in the region, and will likely continue to attract liquidity. Opportunities were particularly visible in quasi-sovereign bonds and high-yield papers. Albeit the country has just entered its rate cycle, mortgage rates were staying close at low levels, lending support to the property sector. Indonesia's first-half property sales already accounted for 44%-61% of managements' full-year guidance, on track to achieving their annual targets. BEA Union Investment anticipated that future sales will stay upbeat, while shopping mall traffic continue to recover. These will generate ample cash flow for developers. In general, property high-yield bonds remained favourable.

On a separate note, valuations were appealing with Indonesia's 30-year quasi-sovereign bonds, especially oil and gas quasi-sovereign investment-grade credits. Festering geopolitical tensions have pushed up demand for coal. Together with soaring coal prices, commodities exporters were awash with cash. Moreover, the sector's solid fundamentals are further cemented by government subsidies. Possibility of defaults is extremely low.

Uncertainties continue to hang thick over Macau high-yield bonds

Revenue of the Macau gaming sector slumped ever since the city experienced its pandemic outbreak mid-June. Timing of border reopening with China remained in limbo. Rating agencies and markets have lowered their expectations towards Macau gaming's recovery this year and next. As liquidity was eroded over time, companies face mounting risks of seeing their credit ratings being lowered. Although some gaming operators received shareholder loans from their parent companies, fundamentals of the sector remained bleak. Our investment teams stayed cautious towards Macau high-yield bonds.