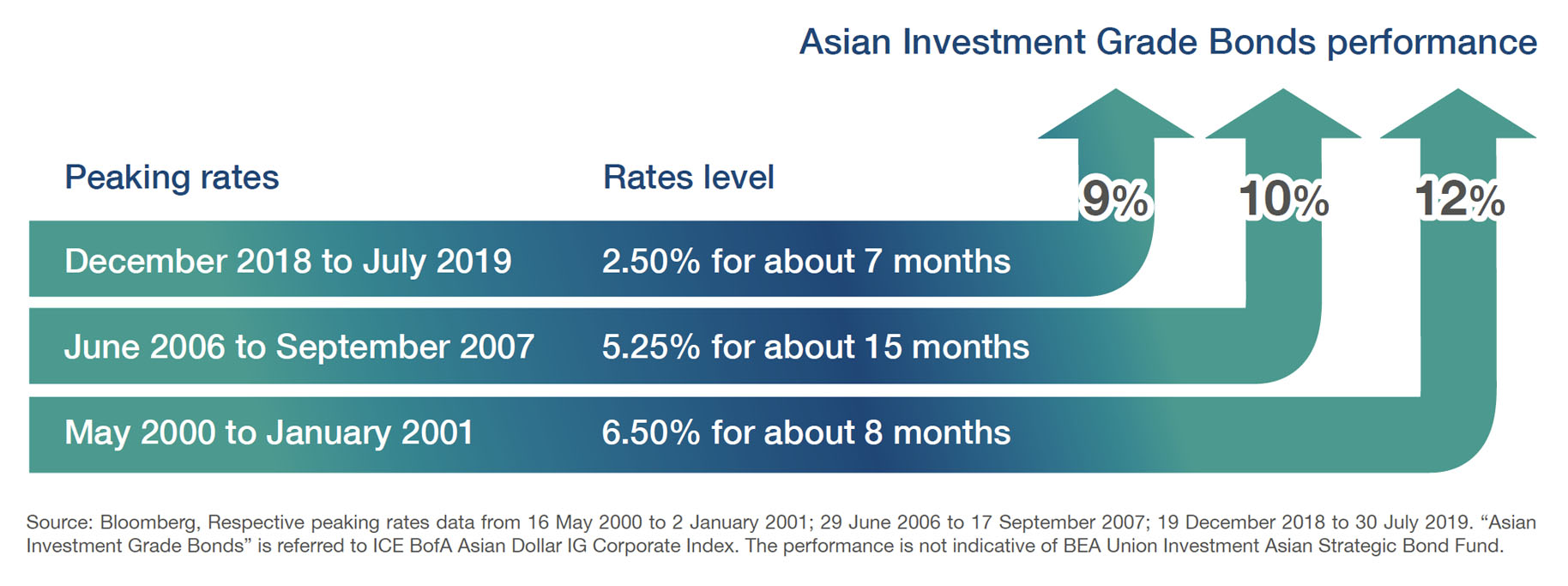

Including Asian Investment Grade Bonds in your portfolio early on to capture opportunities arising from peaking rates

|

|

Based on historical patterns of interest rate peaking, Asian Investment Grade Bonds have started to exhibit an upward trend, reflecting market expectations of a decline in interest rates. |

|

|

With the US rate hike cycle expected to conclude soon, investors may consider proactively allocating their allocations in advance to lock in the current attractive yield and position themselves to benefit from potential bond price appreciation when interest rates drop. |

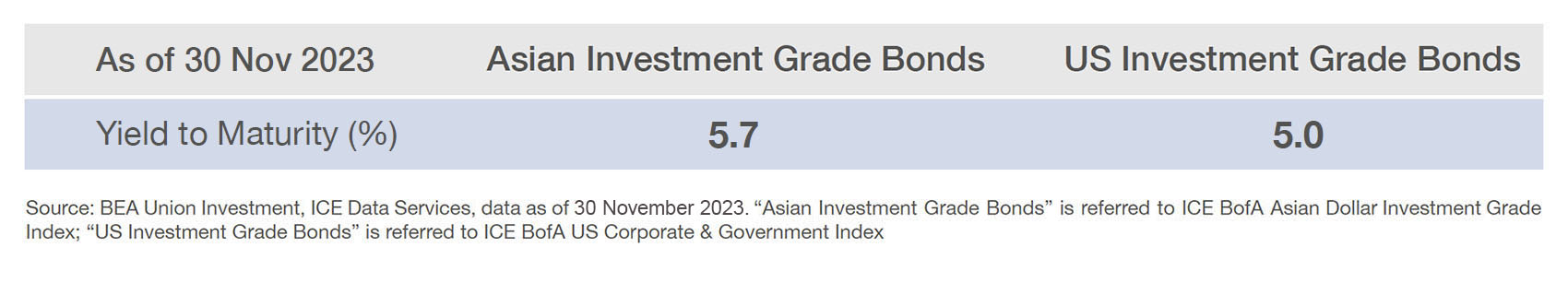

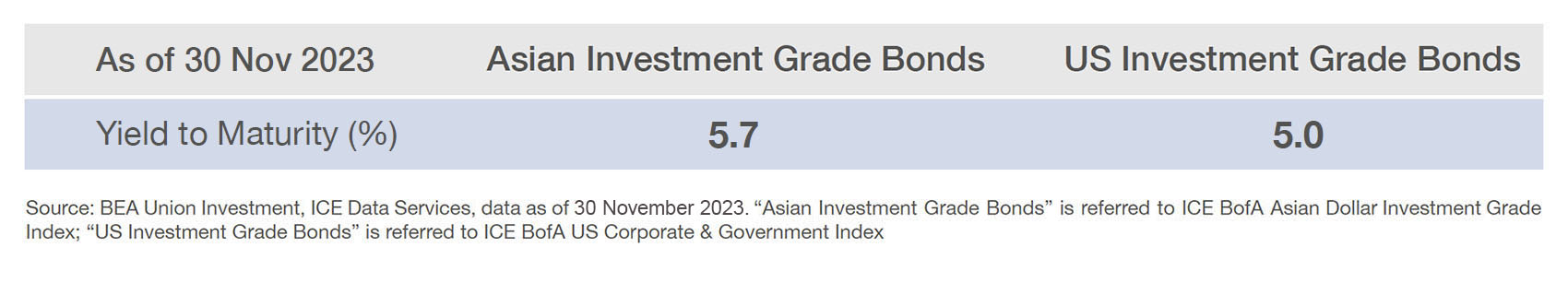

Asian Investment Grade Bond yields appealing; captivating income and capital appreciation potential

Asian Investment Grade Bonds have higher yield to maturity than their US counterparts. It may also enhance the stability and overall returns of an investment portfolio, as it offers a higher 5-year risk-adjusted return (Sharpe ratio8) compared to European and US Investment Grade Bonds.

Asia's economic growth continues to gain momentum

The fundamental outlook for Asia is optimistic, with the International Monetary Fund (IMF) projecting a growth rate of 4.8%9 for Asia this year, surpassing the growth rate of developed economies, which is expected to be 1.4%.

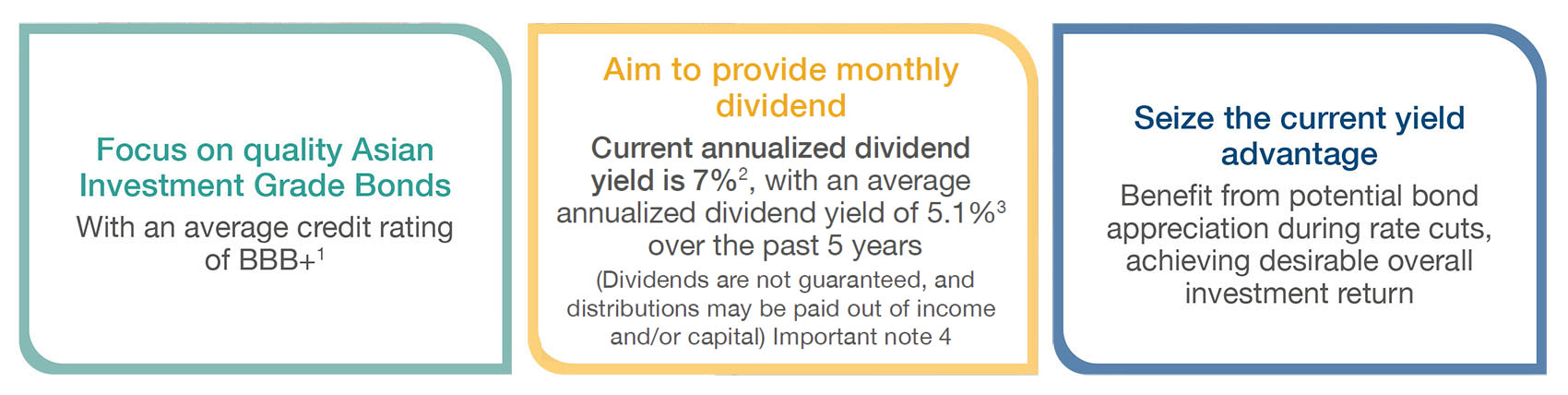

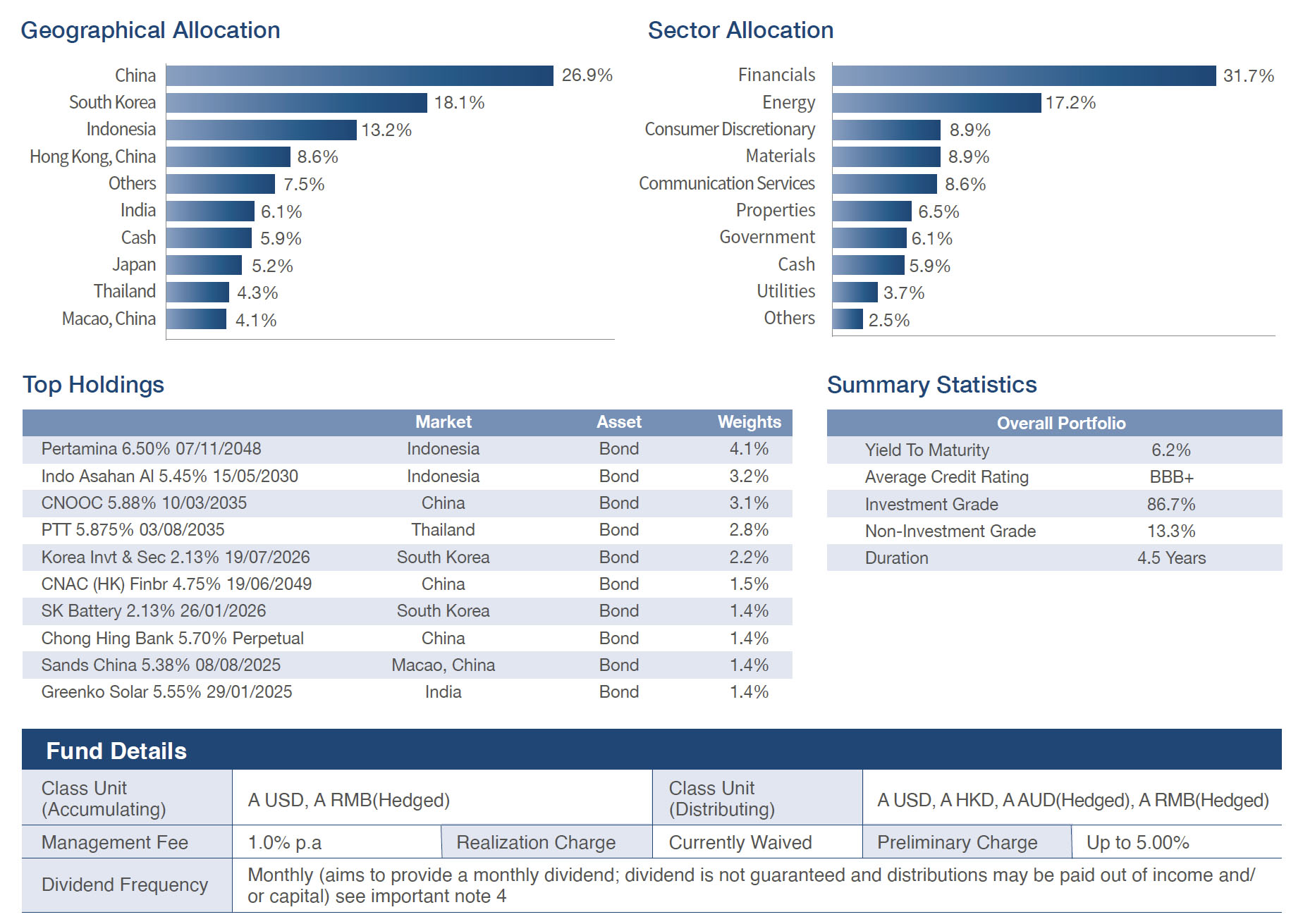

The potential of BEA Union Investment Asian Strategic Bond Fund

Aiming for sustainable income while capturing capital appreciation opportunities

Stay closely attuned to market changes and actively pursue the potential for optimal total returns, with the latest annualized dividend yield reaching 7%2.

Despite the market fluctuations, the portfolio has maintained an average annualized dividend yield of 5.1%3 over the past 5 years. (Dividends are not guaranteed, and distributions may be paid out of income and/or capital) Important note 4

Focusing on high credit-rated bonds to effectively manage investment risks

Utilizing Investment Grade Bonds as the core investments, seeking stable dividends and capital appreciation opportunities.

Strategically allocating to High Yield Bonds for higher returns and alpha generation.

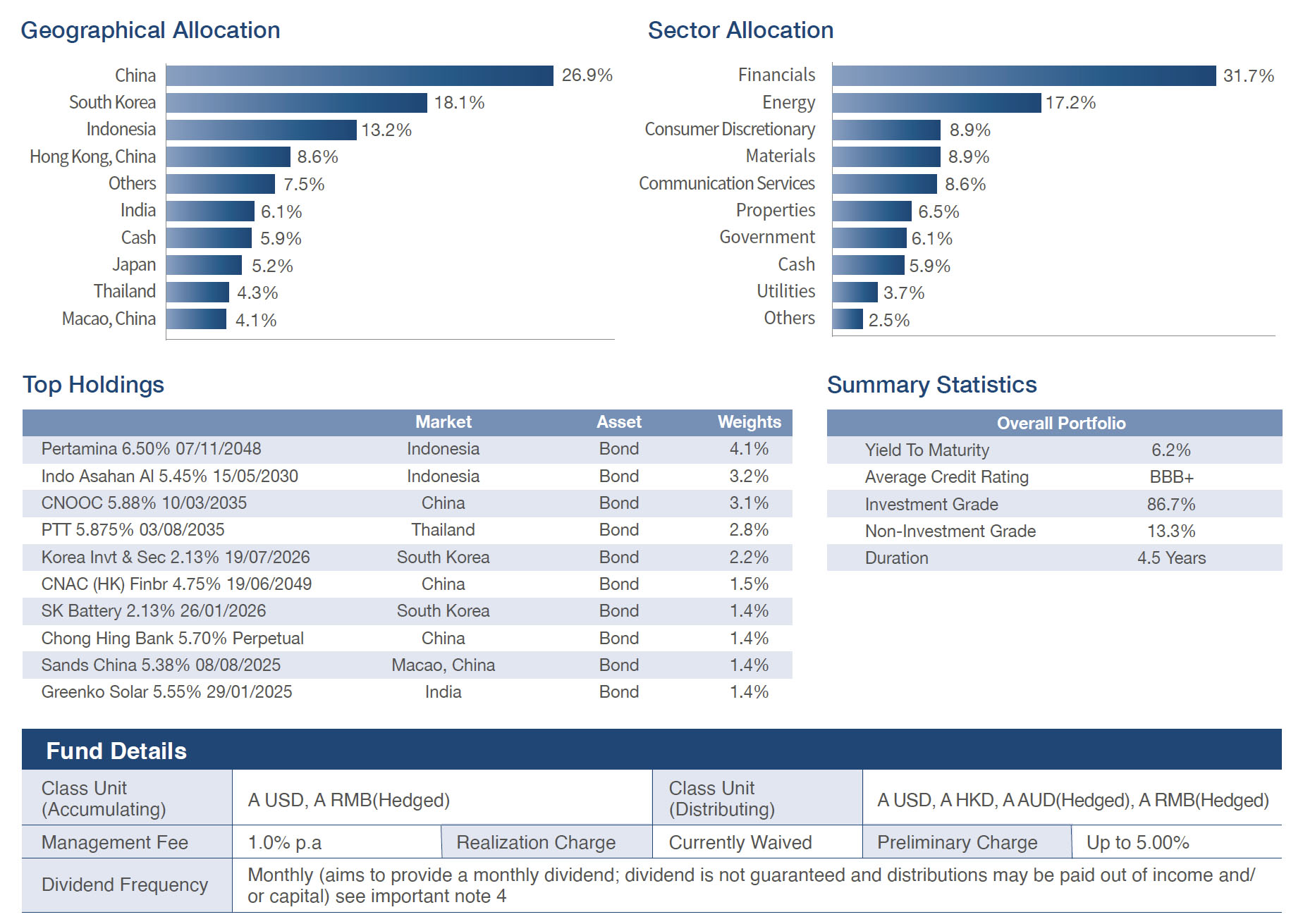

Encompassing high-quality bonds from diverse countries and sectors in Asia

The Asian Investment Grade Bond market offers a wide array of issuances, providing extensive investment opportunities across countries and industries.

Carefully selecting bonds with superior credit quality, attractive yield, and potential for returns, thereby enhancing the overall performance of the fund

Summary of BEA Union Investment Asian Strategic Bond Fund

Source: Unless otherwise specified, all fund data sources are BEA Union Investment as of 30 November 2023. Month-end asset mixes may total greater than/less than 100% due to rounding. As such, the values of the geographical and section allocation displayed may not total 100%.

Important note:

1. BEA Union Investment Asian Strategic Bond Fund (the “Fund”) seeks medium to long term capital growth and regular income by primarily (i.e. at least 70% of its net assets value) investing in debt securities that are (a) denominated in Asian currencies, or (b) issued or guaranteed by Asian governments or entities which are incorporated in Asia or have significant operations or assets in, or derive significant portion of revenue or profits from Asia, and denominated in USD or other currencies including Asian currencies.

2. The Fund is subject to general investment risk, Asian market concentration risk, emerging markets risk and currency risk.

3. The Fund invests in debt securities and are subject to risks in interest rates, credit/counterparty, downgrading, below investment grade and non-rated securities, volatility and liquidity, valuation and sovereign debt and credit rating which may adversely affect the price of the debt securities.

4. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the unitholder’s original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit.

5. In terms of currency hedged class units, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class units may result in a decrease in return and/or loss of capital for unitholders. Over-hedged or under-hedged positions may arise and there can be no assurance that the currency hedged class units will be hedged at all times or that the manager will be successful in employing the hedge.

6. RMB is currently not a freely convertible currency as it is subject to exchange controls and restrictions. Non-RMB based (e.g. Hong Kong) investors are exposed to foreign exchange risk and there is no guarantee that the value of RMB against the investors’ base currencies (for example HKD) will not depreciate. Any depreciation of the RMB could adversely affect the value of investors’ investments.

7. The Fund may use financial derivative instruments for hedging and investment purposes which may not achieve the intended purpose and may result in significant losses. Risks associated with derivative instruments include counterparty/ credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk.

8. Investors should not make an investment decision based solely on this material.

Investments in the Fund are subject to investment risks, including the possible loss of the principal amount invested. For full details and risk factors of the Fund, please refer to the Explanatory Memorandum of the Fund. Investors should also read the Explanatory Memorandum of the Fund for detailed information prior to any subscription. The information contained herein is only a brief introduction to the Fund. Investors should be aware that the price of units may go down as well as up as the investments of the Fund are subject to market fluctuations and to the risks inherent in all investments. Past performance is not indicative of future performance. The information contained in this document is based upon information which BEA Union Investment Management Limited considers reliable and is provided on an “as is” basis. This document does not constitute an offer, recommendation or solicitation to buy or sell any securities or financial instruments. The Fund has been authorised by the Securities and Futures Commission (“SFC”) in Hong Kong. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material and the website have not been reviewed by the SFC in Hong Kong.

Issuer: BEA Union Investment Management Limited

1. Source: BEA Union Investment, data as of 30 November 2023.

2. Source: BEA Union Investment, the mentioned dividend yield is for A USD (Distributing) for November 2023. Annualized dividend yield = (dividend of the current month x 12) / last month end NAV x 100%. Past dividend record is not indicative of future dividend likely to be achieved. Please note that a positive distribution yield does not imply a positive return.

3. Source: BEA Union Investment, the mentioned dividend yield is for A USD (Distributing) and is the sum of the monthly annualized dividend yield for the past 60 months, from December 2018 to November 2023 (60 dividends), divided by 60. Annualized dividend yield = (dividend of the current month x 12) / last month end NAV x 100%. Past dividend record is not indicative of future dividend likely to be achieved. Please note that a positive distribution yield does not imply a positive return. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Investors should note that the distributions paid out of capital amount to a return or withdrawal of part of the unitholder’s original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit.

4. Source: The Asset, 2022 Research for Asian G3 Bonds, performance as of June 2022.

5. Source: The Asset, 2021 Research for Asian Local Currency Bonds, performance as of June 2021.

6. Source: BENCHMARK, performance as of June 2022.

7. Source: Lipper, performance as of 31 December 2020 for 2021 Hong Kong award.

8. Source: BEA Union Investment, ICE Data Services, data as of 30 November 2023. The five-year Sharpe ratios for U.S., European and Asian Investment Grade Bonds are -0.13, -0.36 and 0.12 respectively. “US Investment Grade Bonds” is referred to ICE BofA US Corporate & Government Index; “European Investment Grade Bonds” is referred to ICE BofA Euro Broad Market Index; “Asian Investment Grade Bonds” is referred to ICE BofA Asian Dollar Investment Grade Index.

9. Source: International Monetary Fund, October 2023 World Economic Outlook.

10. Awards from The Asset, AsianInvestor, BENCHMARK, Fund Selector Asia, Fundsupermart.com and Lipper

Main Distributors (In no particular order):

Asia's economic growth continues to gain momentum

The fundamental outlook for Asia is optimistic, with the International Monetary Fund (IMF) projecting a growth rate of 4.8%9 for Asia this year, surpassing the growth rate of developed economies, which is expected to be 1.4%.

The potential of BEA Union Investment Asian Strategic Bond Fund

Aiming for sustainable income while capturing capital appreciation opportunities

|

|

Stay closely attuned to market changes and actively pursue the potential for optimal total returns, with the latest annualized dividend yield reaching 7%2. |

|

|

Despite the market fluctuations, the portfolio has maintained an average annualized dividend yield of 5.1%3 over the past 5 years. (Dividends are not guaranteed, and distributions may be paid out of income and/or capital) Important note 4 |

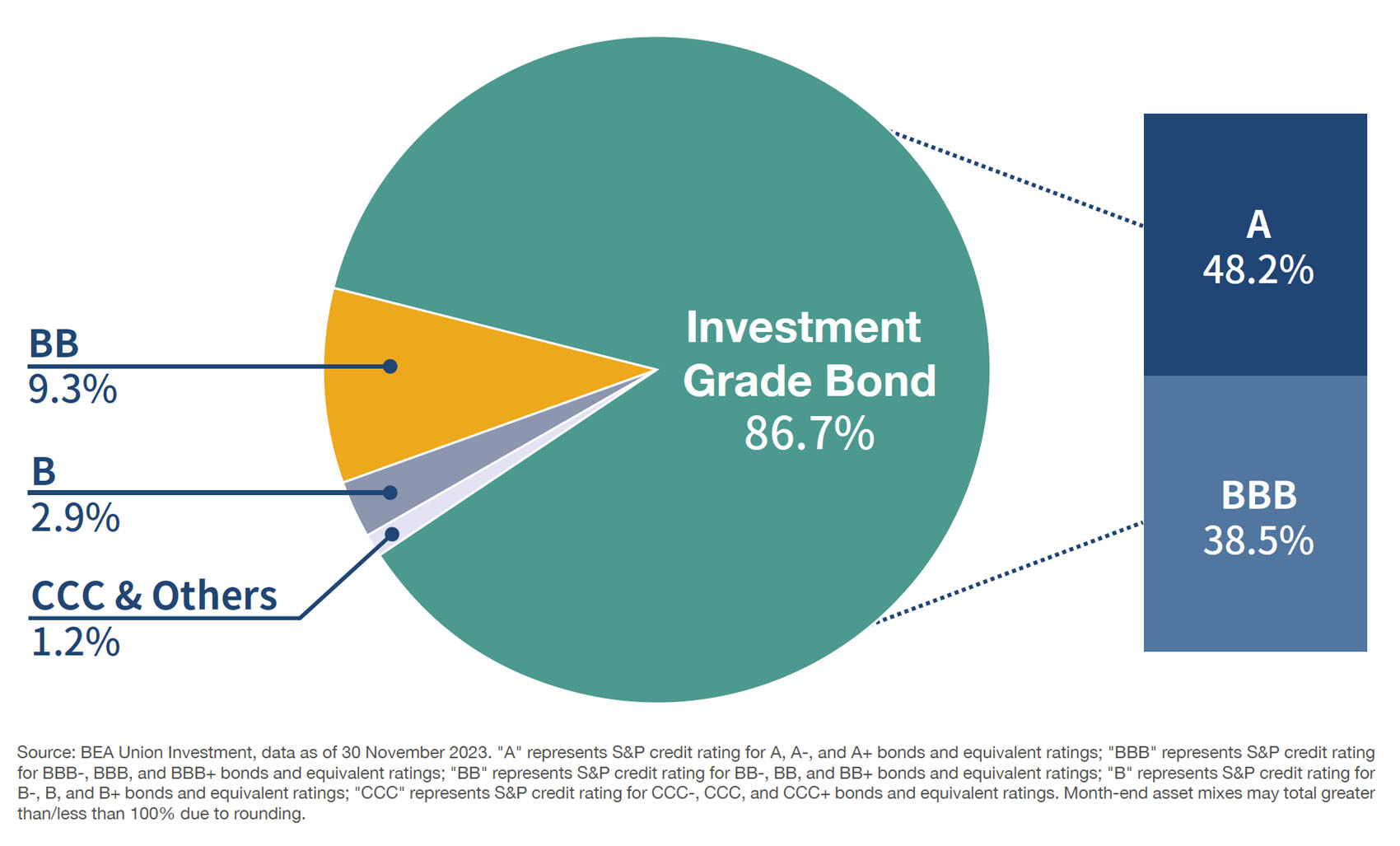

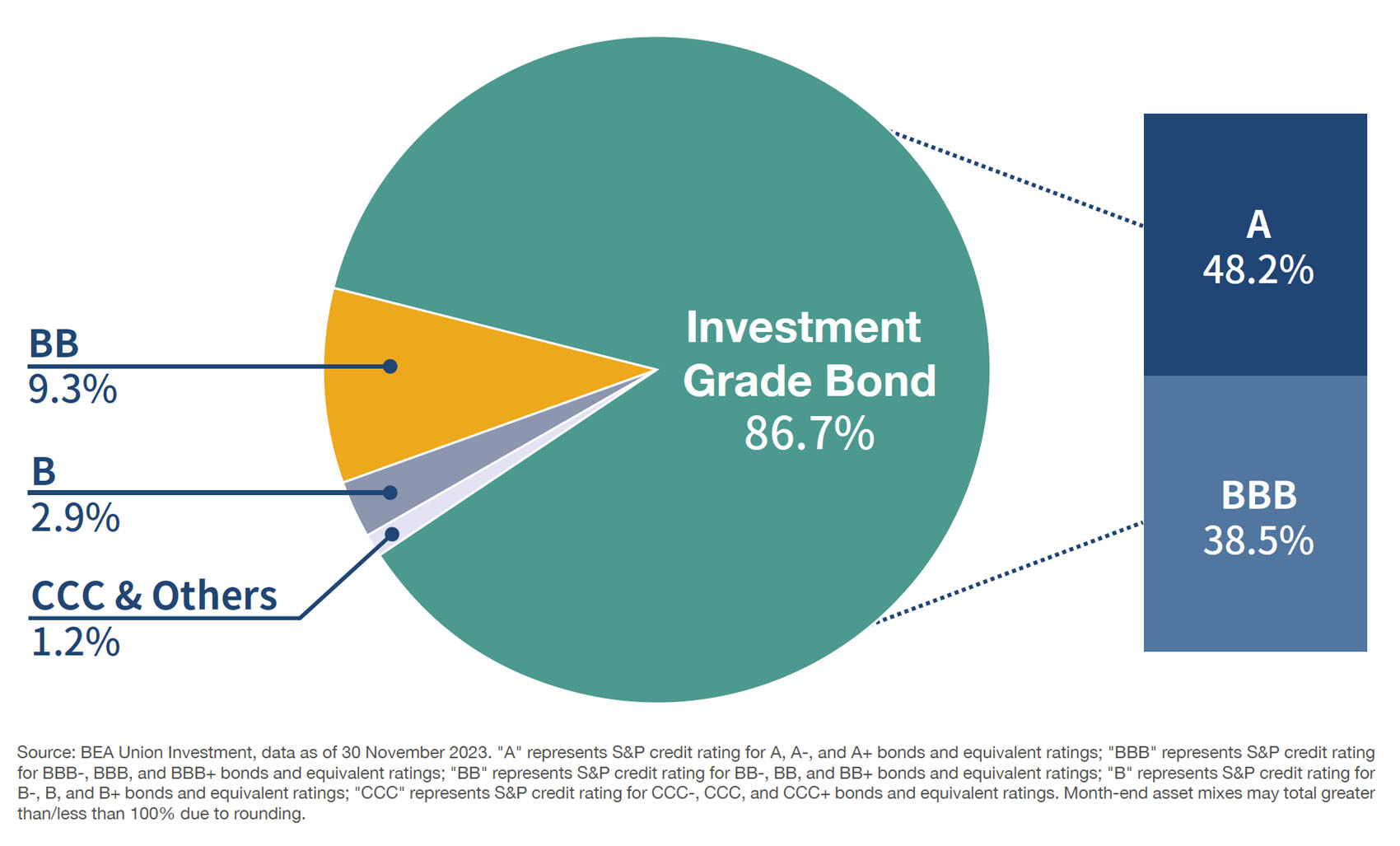

Focusing on high credit-rated bonds to effectively manage investment risks

|

|

Utilizing Investment Grade Bonds as the core investments, seeking stable dividends and capital appreciation opportunities. |

|

|

Strategically allocating to High Yield Bonds for higher returns and alpha generation. |

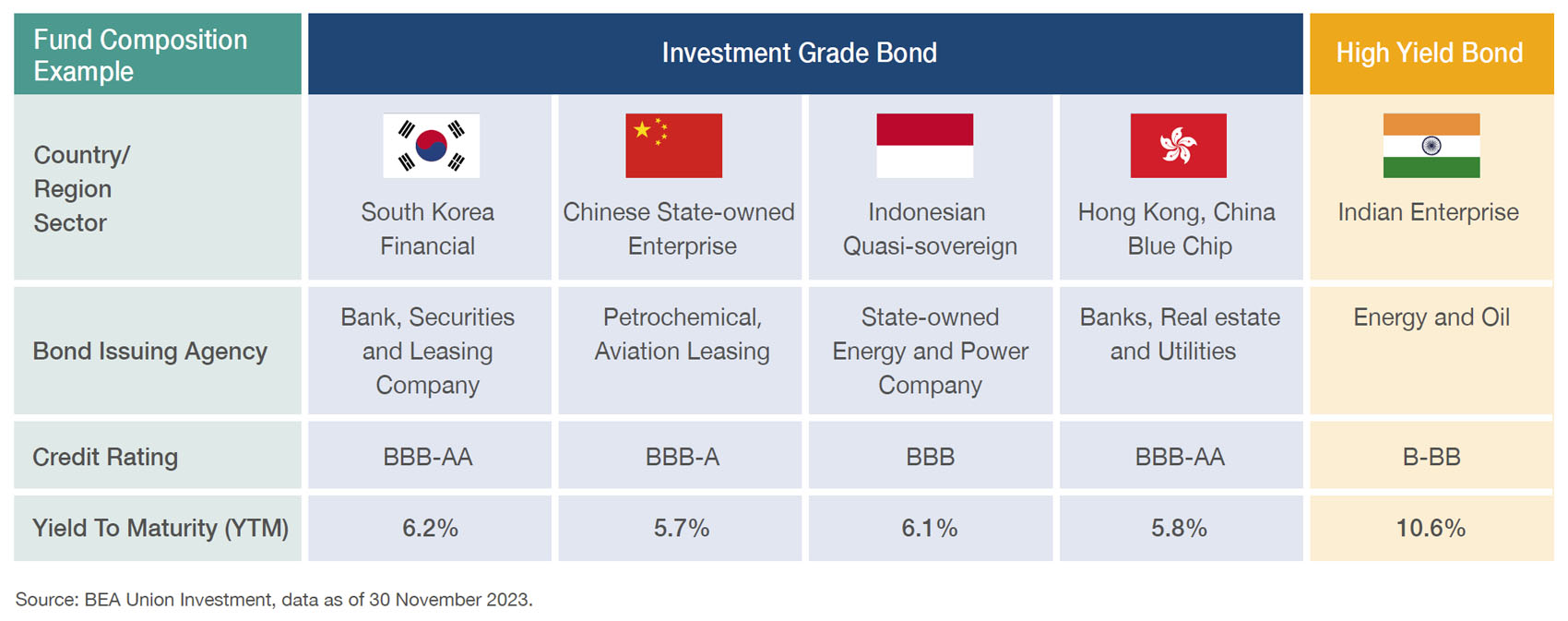

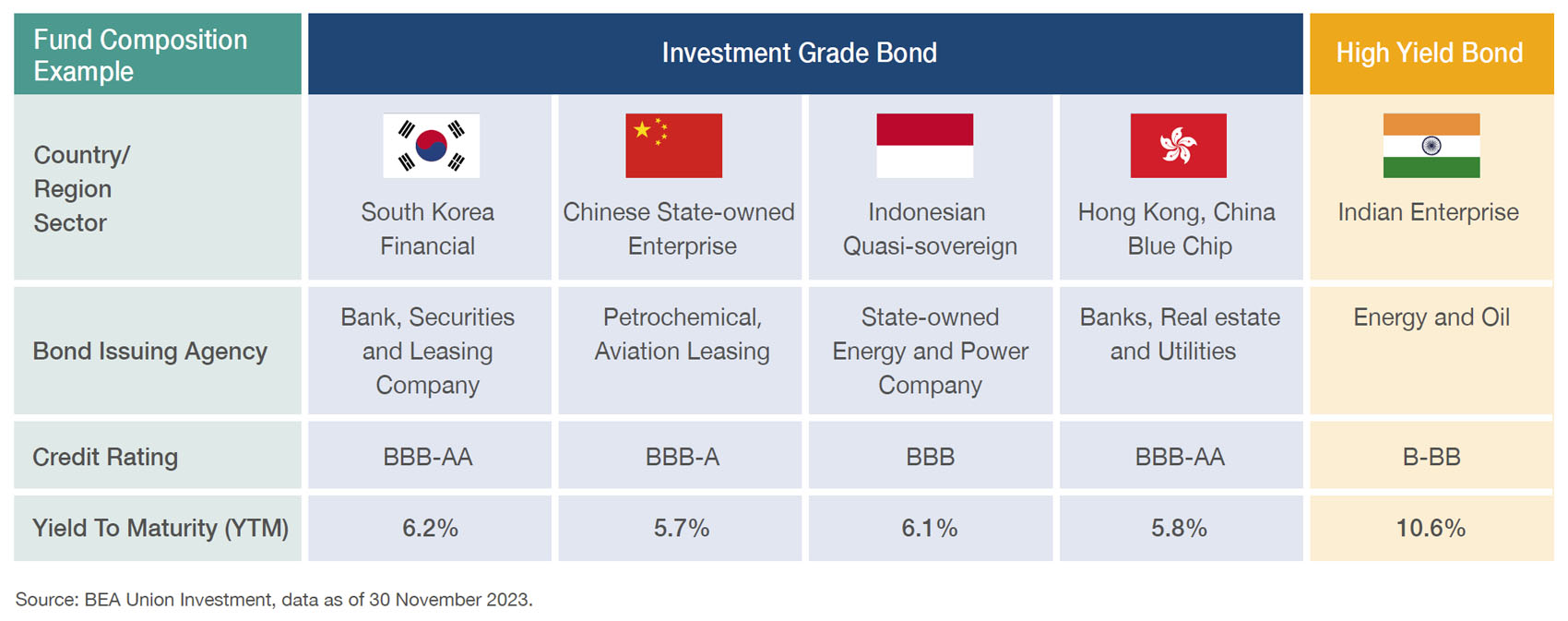

Encompassing high-quality bonds from diverse countries and sectors in Asia

|

|

The Asian Investment Grade Bond market offers a wide array of issuances, providing extensive investment opportunities across countries and industries. |

|

|

Carefully selecting bonds with superior credit quality, attractive yield, and potential for returns, thereby enhancing the overall performance of the fund |

Summary of BEA Union Investment Asian Strategic Bond Fund

Source: Unless otherwise specified, all fund data sources are BEA Union Investment as of 30 November 2023. Month-end asset mixes may total greater than/less than 100% due to rounding. As such, the values of the geographical and section allocation displayed may not total 100%.

Important note:

1. BEA Union Investment Asian Strategic Bond Fund (the “Fund”) seeks medium to long term capital growth and regular income by primarily (i.e. at least 70% of its net assets value) investing in debt securities that are (a) denominated in Asian currencies, or (b) issued or guaranteed by Asian governments or entities which are incorporated in Asia or have significant operations or assets in, or derive significant portion of revenue or profits from Asia, and denominated in USD or other currencies including Asian currencies.

2. The Fund is subject to general investment risk, Asian market concentration risk, emerging markets risk and currency risk.

3. The Fund invests in debt securities and are subject to risks in interest rates, credit/counterparty, downgrading, below investment grade and non-rated securities, volatility and liquidity, valuation and sovereign debt and credit rating which may adversely affect the price of the debt securities.

4. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the unitholder’s original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit.

5. In terms of currency hedged class units, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class units may result in a decrease in return and/or loss of capital for unitholders. Over-hedged or under-hedged positions may arise and there can be no assurance that the currency hedged class units will be hedged at all times or that the manager will be successful in employing the hedge.

6. RMB is currently not a freely convertible currency as it is subject to exchange controls and restrictions. Non-RMB based (e.g. Hong Kong) investors are exposed to foreign exchange risk and there is no guarantee that the value of RMB against the investors’ base currencies (for example HKD) will not depreciate. Any depreciation of the RMB could adversely affect the value of investors’ investments.

7. The Fund may use financial derivative instruments for hedging and investment purposes which may not achieve the intended purpose and may result in significant losses. Risks associated with derivative instruments include counterparty/ credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk.

8. Investors should not make an investment decision based solely on this material.

Investments in the Fund are subject to investment risks, including the possible loss of the principal amount invested. For full details and risk factors of the Fund, please refer to the Explanatory Memorandum of the Fund. Investors should also read the Explanatory Memorandum of the Fund for detailed information prior to any subscription. The information contained herein is only a brief introduction to the Fund. Investors should be aware that the price of units may go down as well as up as the investments of the Fund are subject to market fluctuations and to the risks inherent in all investments. Past performance is not indicative of future performance. The information contained in this document is based upon information which BEA Union Investment Management Limited considers reliable and is provided on an “as is” basis. This document does not constitute an offer, recommendation or solicitation to buy or sell any securities or financial instruments. The Fund has been authorised by the Securities and Futures Commission (“SFC”) in Hong Kong. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material and the website have not been reviewed by the SFC in Hong Kong.

Issuer: BEA Union Investment Management Limited

1. Source: BEA Union Investment, data as of 30 November 2023.

2. Source: BEA Union Investment, the mentioned dividend yield is for A USD (Distributing) for November 2023. Annualized dividend yield = (dividend of the current month x 12) / last month end NAV x 100%. Past dividend record is not indicative of future dividend likely to be achieved. Please note that a positive distribution yield does not imply a positive return.

3. Source: BEA Union Investment, the mentioned dividend yield is for A USD (Distributing) and is the sum of the monthly annualized dividend yield for the past 60 months, from December 2018 to November 2023 (60 dividends), divided by 60. Annualized dividend yield = (dividend of the current month x 12) / last month end NAV x 100%. Past dividend record is not indicative of future dividend likely to be achieved. Please note that a positive distribution yield does not imply a positive return. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Investors should note that the distributions paid out of capital amount to a return or withdrawal of part of the unitholder’s original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit.

4. Source: The Asset, 2022 Research for Asian G3 Bonds, performance as of June 2022.

5. Source: The Asset, 2021 Research for Asian Local Currency Bonds, performance as of June 2021.

6. Source: BENCHMARK, performance as of June 2022.

7. Source: Lipper, performance as of 31 December 2020 for 2021 Hong Kong award.

8. Source: BEA Union Investment, ICE Data Services, data as of 30 November 2023. The five-year Sharpe ratios for U.S., European and Asian Investment Grade Bonds are -0.13, -0.36 and 0.12 respectively. “US Investment Grade Bonds” is referred to ICE BofA US Corporate & Government Index; “European Investment Grade Bonds” is referred to ICE BofA Euro Broad Market Index; “Asian Investment Grade Bonds” is referred to ICE BofA Asian Dollar Investment Grade Index.

9. Source: International Monetary Fund, October 2023 World Economic Outlook.

10. Awards from The Asset, AsianInvestor, BENCHMARK, Fund Selector Asia, Fundsupermart.com and Lipper

Main Distributors (In no particular order):